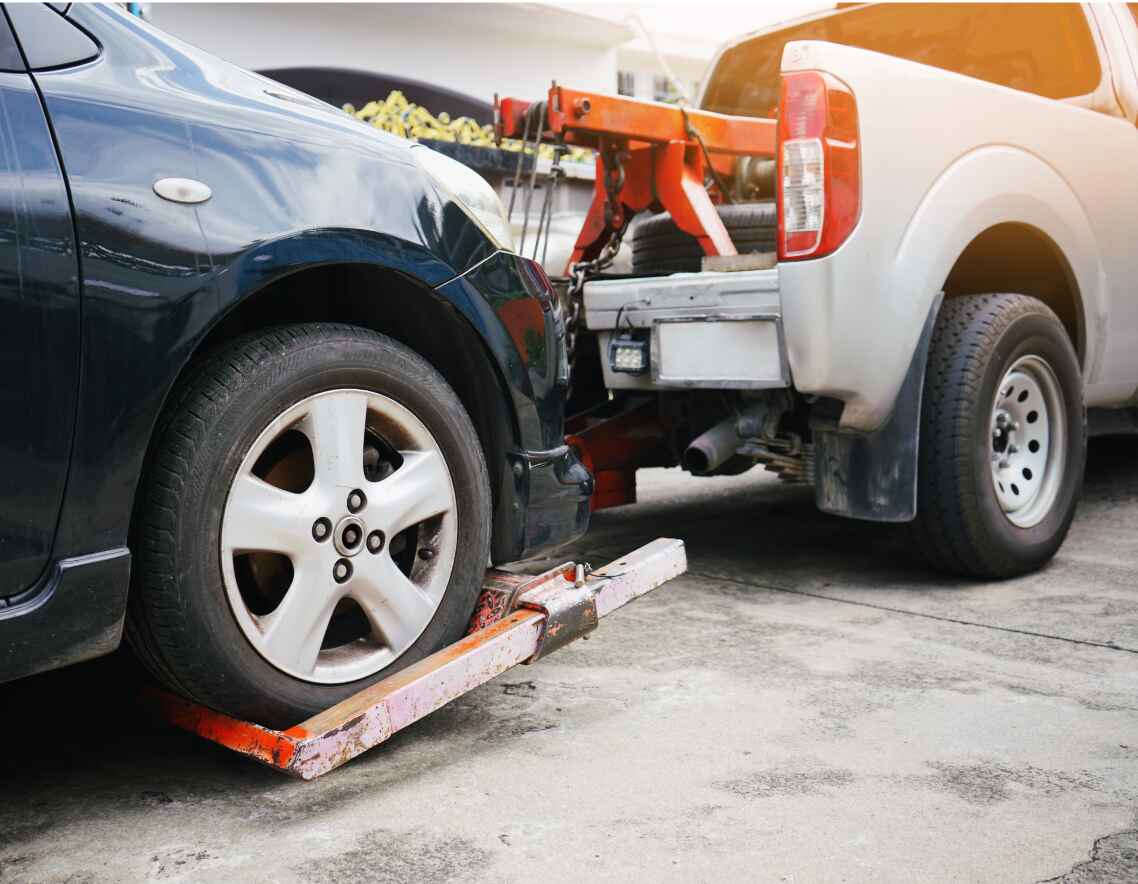

AUTO INSURANCE

Your vehicle is an essential asset. Protect it accordingly.

Your car or truck is important to you and we want to help you protect it. There are so many factors to consider to ensure you have the best protection at the best rates. Let us help tailor the right coverage for you and your vehicles.

Consider our auto insurance services.

An automobile insurance policy is designed to provide you with a level of protection against property, liability, and medical costs if you are involved in an accident:

- Personal Injury Protection pays for the cost of treating injuries, rehabilitation, and sometimes lost wages and funeral expenses.

- Liability Coverage pays for your legal responsibility to others for bodily injury or property damage. Most states require car owners to purchase a minimum of bodily injury and property damage liability insurance.

What coverages are available under automobile insurance?

Automobile insurance is designed to provide you with a level of protection against events that could impact you personally, including fire, damage, theft, vandalism, or anything that causes damage to your car.

Comprehensive Insurance coverage pays for damages caused by an event other than a collision, such as fire, theft, or vandalism. However, just like collision insurance coverage, your policy will pay for damages, minus your deductible, and will cover only the book value of the vehicle.This kind of coverage typically includes windshield repair and glass claims. Owners have the option of purchasing full glass coverage, which will replace your auto’s windshield and other glass without you having to pay a deductible.

Collision Insurance covers damage to your car when your car hits, or is hit by, another vehicle or other object. This coverage is not required by a state, but if you have a loan or a lease, then the lien holder will require it.

Uninsured/Underinsured Insurance coverage covers damages to you and your property caused by another driver who either is uninsured or underinsured to cover your damages. This coverage typically pays for medical treatment, lost wages, and other damages. If your uninsured/underinsured motorist insurance coverage includes property damage, then your vehicle would also be covered under the same circumstances.

Should I consider separate rental car insurance?

When you are renting a car while traveling, on business or pleasure, the last thing you want to think about is an accident that costs you money. More and more rental car companies are seeking to recover the full costs of an auto involved in an accident, especially at a time when average rental car prices have increased.

If you are liable in a rental car accident, there are policies that will cover things like: the rental value for the duration the car is out of service; diminished resale value after a rental auto has been repaired; and a rental company’s expenses incurred while processing the claim. Understanding your options is important to affording you the best protection.

Can I insure my teen driver?

If you’re the parent of a teenager about to get their driver’s license, insuring your new driver can be an expensive endeavor. To help manage your cost and exposure from adding a new driver to your insurance, consider the following:

- Adding them to your auto policy

- Raising your deductibles

- Student discounts

- Having them drive a used versus a new car

Contact a Marshall+Sterling team member today to learn more about the different automobile insurance options that are available for you and your family.

If I take a defensive driving course, will I save some money?

Complete your 6-hour online defensive driving course, on your own time, to save up to 10% on your insurance and reduce points on your license (available in select states). No more scrambling for special reservations on a weekend, only to spend your day off in a crowded classroom.

Click on a state below:

Other solutions from Marshall+Sterling.

Business Insurance

Marshall+Sterling can help you analyze and assess your risk, delivering custom solutions to help you protect your business.

Employee Health and Benefits

We provide our clients with a wide array of choices for cost-competitive programs throughout the insurance industry.

Retirement and Wealth

Dedicated to simplifying the complexities of the financial world and supporting you in achieving and protecting what matters most.

Equine, Farm, and Ranch Insurance

Our Equine Division specializes in personalized plans that encompass a full range of equine, farm, and ranch insurance coverage.