On April 7, 2021, the U.S. Department of Labor (DOL) released various documents pertaining to the COBRA premium assistance provisions contained in the American Rescue Plan Act (ARPA), including Frequently Asked Questions (FAQs) and Model Notices and election forms, as well as the launch of a page dedicated to COBRA Premium Subsidy guidance on its website.

Background on ARPA COBRA Subsidy:

What is it?

From April 1, 2021 through September 30, 2021, group health plans providing COBRA continuation coverage (or continuation coverage under state “mini-COBRA” laws) must offer a 100 percent subsidy of COBRA premiums for “assistance eligible individuals” (AEIs) and their qualified beneficiaries.

The subsidy covers any group health plan covered by federal COBRA continuation coverage or state continuation coverage, except for flexible spending accounts (FSA). The COBRA premium may include medical, dental, vision, and the standard 2% COBRA administration fee. The full premium is reimbursed directly to the employer, plan administrator, or insurance company through a COBRA premium assistance credit.

Who is eligible?

Assistance eligible individuals (AEIs) are qualified beneficiaries who trigger COBRA continuation coverage because of an involuntary termination of employment or a reduction in hours and whose current COBRA continuation coverage period would cover some or all of the subsidy period. Family members who were covered at the time of the involuntary termination or reduction in hours are included.

Individuals who qualify for COBRA because of voluntary termination or other qualifying events (e.g. retirement or dependent aging out) would not be considered AEIs. Individuals who are terminated for gross misconduct are also ineligible.

An AEI is no longer eligible for a subsidy upon the earliest of: becoming eligible for other group health plan coverage (that is not an excepted benefit); becoming eligible for Medicare; or the expiration of their maximum COBRA period.

Extended COBRA Election Period

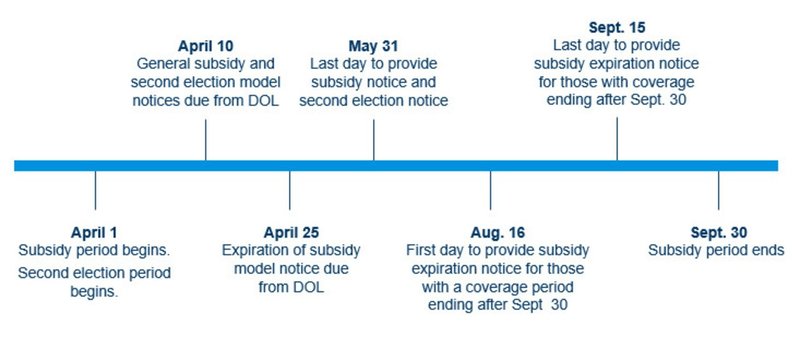

Under the ARPA, an individual who is eligible for assistance and who hasn’t elected COBRA coverage by April 1, or who elected COBRA coverage but then discontinued it, may elect COBRA coverage during a special enrollment period starting April 1 and ending 60 days after the date on which the COBRA subsidy notification was delivered. This second chance to enroll applies to Federal COBRA only, it does not apply to state continuation.

Employers have until May 31, 2021, to provide the notices of the opportunity to elect subsidized coverage. Eligible individuals may receive the subsidy on a prospective basis, without having to elect and pay for COBRA retroactively for months prior to the subsidy becoming available.

Notably, the FAQs state that prior federal COVID-19-related relief for plan deadlines does not apply to notices or election periods set forth in the ARPA provisions about the COBRA subsidy.

Model Notices:

Employers are highly encouraged to use the DOL’s model notices, but as with all DOL model notices, they will need to be customized to accurately reflect plan or employer specific information.

- General Notice and Election Notice: Combines the General Notice and Election Notice of classic COBRA continuation coverage, but includes required ARPA disclosures. To be provided to all individuals who will lose coverage due to any COBRA qualifying event between April 1 and September 30, 2021.

- Notice in Connection with Extended Election Period: Provides required information to anyone who may be eligible for the subsidy due to involuntary termination or reduction in hours occurring before April 1, 2021 (generally, those with applicable qualifying events on or after October 1, 2019). To be provided to those currently enrolled in COBRA, as well as those who did not elect COBRA continuation coverage when it was first offered and may be eligible for the ARPA’s extended election period. This notice must be given to eligible individuals by May 31, 2021.

- Alternative Notice: This notice is very similar to the General Notice and Election Notice, but is for use by insured coverage subject to state continuation (“mini-COBRA”) requirements between April 1, 2021 and September 30, 2021.

- Notice of Expiration of Premium Assistance: This notice provides the required language and information employers will need when informing individuals that their COBRA premium assistance is coming to an end, and is to be provided 15-45 days before premium assistance expires.

Request for Treatment as an Assistance Eligible Individual:

In addition to publishing the model forms, the DOL also published a “Summary of the COBRA Premium Assistance Provisions.” This document must accompany the required notices and will provide individuals with important information regarding their eligibility for the subsidy.

The summary includes an application for individuals to submit to employers in order to be treated as an AEI if they believe they meet the criteria for premium assistance under the ARPA. This “Request for Treatment as an Assistance Eligible Individual” must be returned with an AEI’s completed election form, or separately if they are already enrolled in COBRA continuation coverage. If the form is not completed and returned within 60 days of receipt, the individual may be unable to receive the premium assistance.

The summary also includes a model form for AEIs to notify employers if they no longer qualify for COBRA premium assistance because they become eligible for other group coverage or Medicare. Individuals who do not notify their group health plans as required may be penalized $250, and in the case of intentional failure to notify, the greater of $250 or 110 percent of premium assistance provided after loss of eligibility.

Next Steps for Employers:

Employers should continue identifying all eligible individuals and provide them with the required notices. For employers who use a third party for assistance with COBRA administration, the employer should work with its administrator to ensure that the appropriate notices are being timely distributed.

For employers providing multiple coverage options under its plan, they should determine whether to permit AEIs to switch to a different, less expensive option than the one in which they were enrolled at their qualifying event, as permitted under the ARPA.

While the publication of model notices is helpful in allowing employers to move forward, forthcoming guidance from the IRS will be instrumental in providing greater detail on the exact process employers will follow to claim available COBRA premium assistance tax credits. We are also awaiting further state guidance regarding implementation of the subsidy for employers subject to state continuation coverage (“mini-COBRA”) laws.

We will continue to monitor this issue and will provide relevant updates as they become available .

Notice Timeline:

Employee Health and Benefits