Reminder: 2017 Benefit Limits

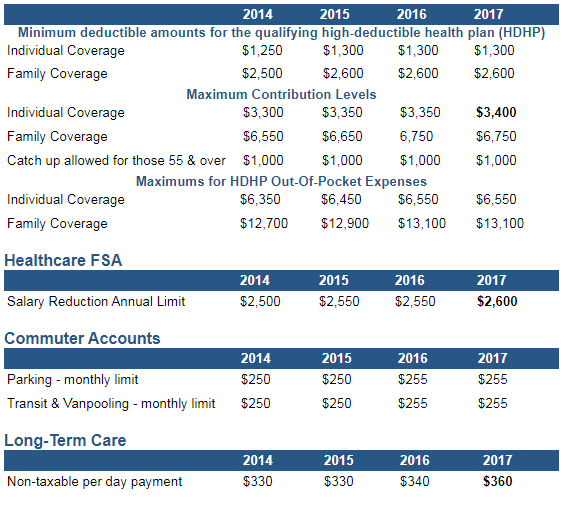

Annually, the IRS and SSA release cost-of-living adjustments that apply to dollar limitations set forth in certain IRS Code Sections. The Consumer Price Index rose 0.3% and therefore merited minor increases in some indexed figures for 2017.

These limits are of interest to employers and sponsors of benefit plans, especially during annual open enrollment time and with the new year just around the corner. A summary of key 2017 index figures and benefit limits are outlined below.

Health Savings Account (HSA)

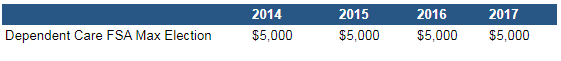

Dependent and/or Child Daycare Expenses

The daycare expense limit associated with a cafeteria plan is not indexed, though the tax credit available through a participant's tax filing was raised in 2003. The daycare credit must be filed on Form 2441 and attached to the 1040 tax filing form. The limits for the daycare credit expenses are $3,000 of expenses covering one child and $6,000 for families with two or more children. If one of the parents is going to school full time or is incapable of self-care, the non-working spouse would be "deemed" as earning $250 per month for one qualifying child and $500 for two or more qualifying children. This "deemed" earned income is used whether a person is using the employer's cafeteria plan or taking the daycare credit.

The cafeteria plan daycare contribution limit is $5,000 for a married couple filing a joint return, or for a single parent filing as "Head of Household." For a married couple filing separate returns, the limit is $2,500 each. The daycare credit is reduced dollar for dollar by contributions to or benefits received from an employer's cafeteria plan. An employee may participate in their employer's cafeteria plan and take a portion of the daycare expenses through the credit if they have sufficient expenses in excess of their cafeteria plan annual election, but within the tax credit limits.

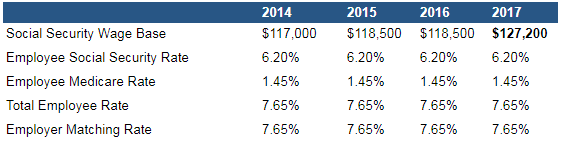

Social Security and Medicare Wage Base

For 2017, the Social Security wage base is $127,200. The Social Security rate of 6.2% is applied to wages up to the maximum taxable amount for the year; the Medicare portion of 1.45% applies to all wages. In addition, starting with the 2013 taxable year, individuals are liable for a 0.9 percent "Additional Medicare Tax" on all wages exceeding specific threshold amounts.