Mid-year Check on ACA Compliance with Self-Audit Tool

|

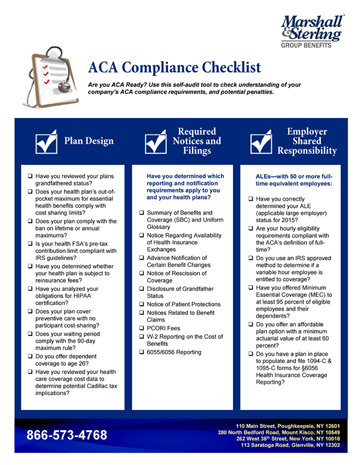

Are you ACA compliant? The Affordable Care Act (ACA) is in full swing this year! When the ACA was signed into law in 2010, it was about 2,500 pages long. However, additions to the law over the past 5 years have reached nearly 40,000 pages! The lengthy and often confusing regulations contain numerous provisions which have and will come into force at varying dates. Critical portions of the ACA are effective in 2015, including the Employer mandate and IRS informational reporting. Still, other provisions-such as the Cadillac tax-won't phase into effect until future years. ACA implementation and its many moving parts impact all employers, both large and small. As we pass the midpoint of 2015, it is an appropriate time to take stock of the measures you have completed and those you will need to take regarding ACA compliance. At Marshall & Sterling, we want to make sure our clients are informed and ACA ready. Use the following link to access our ACA Compliance Checklist to verify understanding of your company's ACA compliance requirements and potential penalties.

As always, do not hesitate to reach out with any questions or concerns.

|