IRS Extends Due Date for 2020 ACA Reporting to Individuals

Similar to prior years, the Internal Revenue Service (IRS) has extended the deadlines for delivery (but not filing) of the 2020 Forms 1095 required by the Affordable Care Act (ACA) via Notice 2020-76.

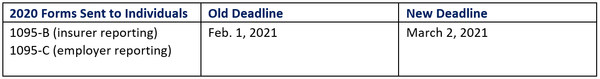

For 2020, the individual furnishing deadline was Feb. 1, 2021, as the normal Jan. 31 deadline falls on a Sunday. As shown above, the IRS has provided an additional 30 days for furnishing the 2020 Form 1095-B and Form 1095-C to enrollees and employees, extending the due date from Feb. 1, 2021, to March 2, 2021. No request or other documentation is required to take advantage of the extended deadline.

It is important to note that the IRS has not extended the due date for filing 2020 Forms 1094-B/1095-B or 1094-C/1095-C with the IRS. The IRS filing deadline remains unchanged at March 1, 2021 if filing on paper and March 31, 2021, if filing electronically (electronic filing is mandatory for 250+ forms).

Final Extension of Good-Faith Relief for Filing and Furnishing

In addition to extending the deadline for furnishing 1095 forms to individuals, IRS Notice 2020-76 provides that 2020 will be the final year employers and insurers can utilize “good faith” relief from penalties related to incorrect or incomplete ACA information returns, clarifying it was intended to be transitional relief only.

As always, please do not hesitate to reach out to our Group Benefits team with any questions.